Why Cat Financial?

Cat Financial isn’t a traditional financial institution. We’re part of the Caterpillar family, just like you. We understand things other lenders don’t, and we work hard to support your success — whether you’re looking to acquire a new or used machine, protect your investment beyond the warranty or tap into the equity in your equipment to move your business forward.

Why Cat Financial?

We work for you.

As a “captive” finance company, we work for Caterpillar customers and Caterpillar customers only. When you invest in Cat® equipment, we invest in your success.

We know your business.

We’re experts in the industries Caterpillar serves. We understand your equipment, your challenges and how financing and extended protection can help you reach your goals.

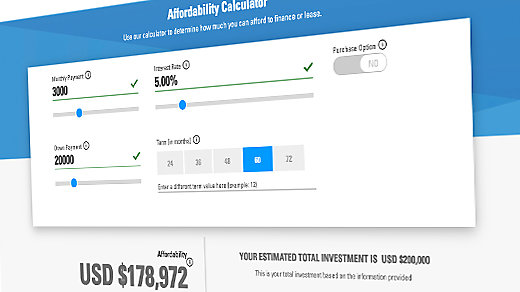

We make things easy.

You can select, finance and protect your equipment in one trip to your local Cat dealer — and put the time and effort you save back into running your business.

We tailor solutions.

Sometimes you need more than a loan or a lease. We can set up custom financing packages to meet your business goals.

We stay flexible.

We’re here to help you succeed not just in good times, but in tough times, too. We’ll modify terms, set up skip payments, restructure debt — whatever it takes.

Service for the life of your equipment

Purchase: Whether you need a lease or loan to acquire new or used equipment, or funds to keep your business growing, you can count on us for quick credit approval and high approval rates.

Protect: Your peace of mind is our priority. Once you’ve invested in new or used Cat equipment, we help you work with your dealer to protect that investment with coverage that goes beyond the standard warranty.

Manage: We’re here with what you need, when you need it. Ask for help navigating through tough financial times.

Resell: Our end-of-term solutions keep your business growing. Choose the option that’s best for you: purchase, refinance or return. We even offer used equipment at lower price points.